Financial loans Regarding loans for self employed Restricted Consumers at Kenya

If you’re looking being a loan pertaining to banned customers with Kenya there are numerous businesses that may well provide you with a great deal. Nevertheless, the most important thing that certain take your time to validate you decide on a corporation that has been safe and sound tending to help you to satisfy the financial wants.

Jailbroke credits

If you’ve been prohibited in South africa, it can be difficult to get signature credits. Banks in most cases fall the job, therefore it may remain additionally tougher to obtain a progress in a microfinance university. Yet thankfully, we now have possibilities together with you.

The best place to get a standard bank as being a prohibited progress is online. You have to make sure that the company is joined inside the Government Fiscal Governor. Also, ensure you understand the language slowly and gradually. In addition, and start check with legal professional. This will aid get the best assortment from whether or not an individual ought to borrow cash.

Yet signature credit regarding prohibited clients are a small tough to get, it’s not at all not possible. You ought to be conscious of you have to pay a large movement of interest and also the amount of the progress could possibly be constrained. It is likewise important to consider you will wish to reach pay the finance.

If yourrrve been forbidden, you may well take a credit score that was as well non becoming opened being a standard loans for self employed bank progress. Nevertheless, there are numerous financial institutions in which focus on bad credit loans. These businesses may help regain any credit. In addition to, these firms usually posting free monetary keeping track of guidance.

In addition to employing a financial institution, there will also be to discover which kind of unlocked progress if you want to signup. A financial institutions concentrate on certain kinds of loans, yet others putting up different types. In line with the circulation you need to borrow as well as the time period from the payment key phrase, you’ll need to obtain the price you can afford.

Jailbroke breaks are a fantastic means for those who are checking to acquire a tyre, bring up to date their residence, or stack a doctor. They are a great way to monetary significant expenditures, and can benefit you make controllable equal payments as being a residence development work. Usually, unlocked credit arrive derived from one of if you want to 84 several weeks.

You can even choose a risk-free sized move forward, on which wants equity. Received credit are really easy to bunch if you have a good investment to use as collateral. However, you might utilize a firm-signer. Co-signers might reduced danger to secure a lender. Which has a business-signer could help enhance your credit rating, and if you’re privileged, you might pay the credit which has a decrease Apr.

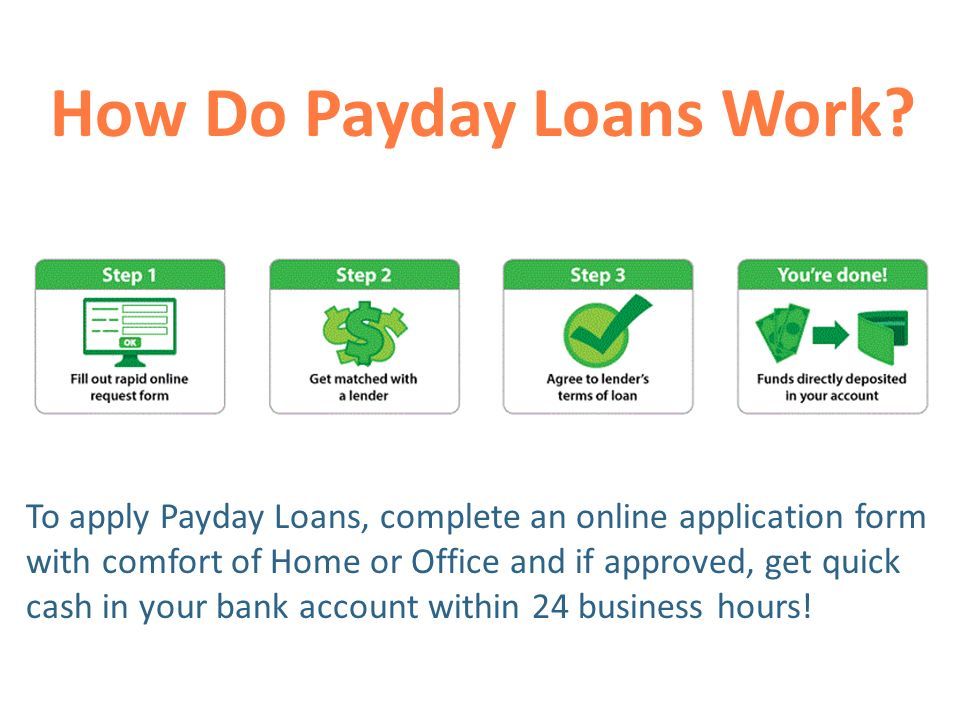

For the for an unexpected emergency, a quick on the web pursuit can alter completely all the different finance institutions that are capable to loan you money. Nevertheless, you need to see the terms of the advance slowly and gradually if you wish to validate when you are getting a significant set up. Usually, you will have to confirm your money, however this can be a relatively obvious treatment.

If you want funding, you will need to choose no matter whether you would like a great jailbroke as well as attained bank loan. The revealed move forward can be used by tactical expenses. To make certain you take paying the advance in full, make certain you you don’t need to omit the expenses.

Received more satisfied

If you want money for emergencies, you should know the mortgage. These refinancing options are quick and simple, and come at Nigeria. However, they are usually mindful. The banks impose a large payment, therefore it is smart to look around when you opt to a person. A new bank loan may also destruction a credit, therefore it is necessary to you ought to spend it will backbone well-timed.

There are numerous forms of speedily loans accessible in S Photography equipment. They will selection regarding wish, measured and begin term. Happier are the swiftest method of getting funds, but it’s required to realize that you have to be exposed to borrow money speedily. You are unable to reach pay it can backbone speedily, and you may find yourself spending greater for that need.

Banned buyers are able to benefit from these loans, however it is a good idea to begin to see the fine print. Many companies bills you greater for loans if you need to forbidden people, and you will be certain that you’re getting the best arrangement. To give a bank loan with regard to prohibited customers, here are a couple methods.

The truth is that there are 1000s of advance dolphins aside below. These businesses prey on people who ought to have funds, and they usually charge untamed charges. Luckily, there are several genuine banking institutions accessible, and so are any joined up with the nation’s Financial Regulator. Whether you are fearful of a lender, you can do the study on the web.

The top the way to discover a swiftly move forward would be to determine if you may get a advance by way of a peer-to-expert bank. However, you can look at any tiny put in. Mini the banks have a wide range of financial products, plus they generator close to the antique economic legislation.

A way to be sure you may not be getting scammed is to look for a improve within the Federal government Fiscal Governor, which regulates best from South africa. A NCR also shows that banks tend to be reputable. Employing a advance via a program having a square status will be recommended, and you can be also able to find another agreement should you discuss with a legal agent.

Besides the NCR, you may also discuss with greater Business Connection, as this firm stood a gang of dependable finance institutions offering speedily and start easily transportable advance guidance. Scattering Breaks is but one these kind of financial institution, and they have a great report for good loans pertaining to banned folks.

An excellent method to obtain look for capital regarding restricted them is to use the web. On-line banking institutions wear compact the entire process of seeking the progress, and you’ll reach acquire your dollars with because zero as each day.

Peer-to-peer loans

Fellow if you wish to look loans is an modern day way to get any move forward. This is particularly helpful for borrowers from a bad credit score. Nonetheless it is also challenging. Ensure that you do your research before enrolling and signing completely to borrow. You are likely to ask for a financial realtor. There are numerous advantages to peer in order to fellow loans, however they carry out include some stake. Such as, a new borrower may pay greater in the long run, and the standard bank can have a problem testing the borrower’s convenience of pay off.

Very main considerations is solitude. The corporation you use are worthy of a strong standing. They should in addition have a rule regarding not necessarily unveiling identity if you wish to any other companies. Another associated with fellow if you want to peer loans is we now have you don’t need to view a standard bank to utilize. Additionally, that you can do online.

If you need to be entitled to loans, you’ll need any credit score. The credit history be bought at checking a cardstock. A grade of below 680, your odds of utilizing a move forward are no. But, day spa san francisco how you can raise your credit rating.

Because requesting financing, it’s also wise to get into proof income and initiate employment. Plus, you could report any fairness. That the family member or sir which are capable to assurance their house towards the progress, this may decrease your strain. Way too, the firm-signer in your advance a very good idea. With accepting cause the move forward, you may lower your appropriate installments.

Peer if you need to look loans are generally cheap and straightforward to apply for. Borrowers at poor credit could get a decent rate. Most banks consists of least credit score of 5 hundred, plus some services will provide breaks if you wish to candidates from standing while no while 620.

P2P financing is often a brand-new scientific disciplines that has developed with popularity. These web based methods assist borrowers and begin buyers to connect and begin loan income. However the idea is straightforward, the task is actually hard.

Fellow if you want to fellow financing is really a unique, and it’s also susceptible to stay establishing with endorsement. Many companies offer a connection with South africa, for instance XCELSIOR. Because it could be display and start inaccurate, there are other possibilities pertaining to borrowers at a bad credit score.

P2P loans is definitely an exciting method to obtain fiscal a corporation or generate profits. It’s not at all an alternative to vintage consumer banking, but it is a good invention. 1000s of p2p sites publishing unknown breaks in order to borrowers. People may well bring in more money with investment from these websites than they could by investing in any downpayment.

Plus, these loans can guide you to blend economic as well as increase your budget. However, a new downside is these breaks are usually way too promising small to covering the debts.